I

t takes a large upfront investment as well as a lot of nurturing to create passive income streams. These income streams will grow and become self-sustaining with hard work and time.How to Earn Passive Income

How to Earn Passive Income

It’s important to clarify some misconceptions before we dive into passive income. While passive sounds like you don’t have to do anything to earn the income, it is not true. Each passive income stream will must at smallest one of these two elements:

Passive Income Ideas Must an Initial Monetary Investment

Passive income requires you to put money down to make the passive income. You don’t have to worry though, as you can start with $5 for some of these ideas. It’s possible for anyone.

1. Dividend Stocks

Dividend stocks can be a reliable way to generate passive income. To receive large dividend checks, you will need to do a lot of research and do a lot of research. You can build a nice income stream if you continue to invest in dividend stocks.

You can get rewards by opening an account at the top online brokerage for any of these investment options.

2. Rental Properties

Renting a cash-flowing rental property can be a great way to generate a monthly income. You can also outsource the management of the properties to make them passive.

The internet makes it easier to invest in rental properties. There are many ways to invest in rental property depending on your goals and interests. You can either be a limited partner in commercial or residential properties or you can buy homes online and become a landlord.

3. High Yield Savings Accounts and Money Market Funds

A high yield savings account, or money market fund, is a good place to start if you don’t care about money.

It all comes down to the type of account and where it is located. FDIC-insured high-yield savings accounts are located at banks. You can find money market funds at either banks or investment companies. They are only and sometimes FDIC insured.

The interest rates are rising so it is a good idea to put more money in a savings account. It can help you generate passive income.

CD Ladders

To build a CD ladder, you will need to buy certificates of deposits (CDs) from banks in specific increments. This will allow you to earn a higher return. Banks offer CDs and they have a low risk of investment. They also provide a low return. This is a great option for those who are cautious about taking on risks.

If you are looking for a 5-year CD ladder, here’s what you should do: These are estimates of how rates change over time.

- Year CD – 2.50%

- 2 Year CD – 2.9%

- 3 Year CD – 3.05%

- CD for 4 Years – 3.10%

- CD for 5 Years – 3.15

You don’t have to build a CD ladder if you find it difficult. A traditional high yield savings account or money market fund can be used. Although the returns aren’t as impressive as some of these other items, they’re still better than nothing and passive income.

5.Annuities

Annuities can be an insurance product you buy, but they also provide a passive income in the form of monthly payments. Annuities come with varying terms so make sure to speak to a trusted financial advisor before you buy one.

These investments may not be right for you. They can have high fees and might not be worth the risk. This could be a great idea for your portfolio if you can tolerate loss and have a desire for passive income.

6. Invest in the Stock Market

There are still passive ways to invest in the stock market, even if you don’t want to pick dividend-paying stocks. A Robo-advisor allows you to invest in different ways.

A Robo-advisor works as it sounds – it is a robot financial advisor. It takes about 10 minutes to answer a few questions, set up your account, and then the system does the rest.

7. Put resources into A REIT (Real Estate Investment Trust)

Whether you are a novice investor or concerned about investing in real estate, it is possible to do so. Real estate can still be included in your investments via REITs – Real Estate Investment Trusts.

These investment vehicles hold property – you, the owner, get to reap the benefits of the sale, refinances, income (or loss), and gains.

8. Invest in a Business

You can also generate passive income by investing and being a silent partner in a company. Although this is risky, it can bring high returns. Lyft and Uber, for example, were seeking private investors to invest in the companies several years back. They are now worth billions of dollars, but investors would not be able to reap the benefits if they went public via an IPO or were acquired. So, it’s risky.

There are many ways to lower your risk. You can, for example, invest small amounts in many companies by lending money to them in small bonds.

9. Invest in Student Income-Share Agreements

An Income-Share Agreement is an alternative for student loans. An ISA allows students to pay for their tuition in exchange for a part of their future income.

Who funds these ISAs they are funded by universities and private investors. The investors make a bet about a student’s future.

These are most common at coding schools and trade schools. But, they are increasing in popularity.

Edly allows you to invest in ISAs. You can either invest in the note or in a fund they use to hold future notes. There might not be any notes open to investment depending on the timing.

10. Refinance your Mortgage

Although it may seem strange to mention this in passive income articles, refinancing your mortgage could be a great way of generating income and saving you up to $100,000 over the loan’s life. This is a very good return.

Interest rates are at historic lows right now. If you haven’t reviewed your mortgage recently, it’s a great opportunity to compare rates and shop around. You could be adding thousands to your bank account if you can save as much as 0.50% on your loan. This is a rare investment.

11. Pay off or reduce debt

Like refinancing your mortgage loan, if your debt can be paid off or reduced, you are making great progress in building your income. Like other topics, it takes financial investment to make this happen.

Paying off debt is a great way to get a straight return. Paying off a credit card with 10% interest is 10% of your money. That’s huge.

You have two options when it comes to debt: refinance, join or balance transfer and reduce.

Refinance student loan debt can make sense if you have student loans. You can see if refinancing makes sense without having to do a credit check. Credible

12. Peer to Peer Lending

P2P lending refers to the lending of money to borrowers who aren’t eligible for traditional loans. You have the power to choose the borrower and can spread your investment to reduce your risk.

Peer Street currently has the best lending platform. These loans can be used to buy real estate.

This is a great deal because you don’t have to lend any money and get the principal and interest back.

Cash flow returns are 4.1%, which is higher than any money market funds you can find. You can also check out CD alternatives.

13. Online selling of eBooks

Self-publishing is a popular option today. There’s a good chance that you are purchasing a self-published eBook when you buy an eBook from Amazon. Self-publishing is easy. This was something I tried a few years back and it was so easy.

You will need to first write the book, edit it, make a cover and upload it to a program like Amazon’s Kindle Direct Publishing. You shouldn’t expect immediate success. This will must a lot more upfront marketing to make it a passive income stream.

14. Udemy allows you to create a course

Udemy allows users to take online courses on a variety of subjects. You don’t have to be an Udemy consumer. Instead, you can become a producer and create video courses that users can buy. If you have a lot of knowledge of a particular subject, this is a great option. This is a great way for tutors to make passive income streams.

15. Selling Stock Photos

Ever wonder how your favorite blogs, websites, and magazines got their photos? They are usually purchased from stock photo sites. You can submit photos to stock photo websites and earn a commission for each person who purchases one.

Deposit Photos is one of the largest marketplaces for selling stock photos. Upload your photographs and bring in cash each time somebody utilizes them.

Check out this amazing story about a scholarship winner who transformed photography into a stock photo company.

16. Licensing music

You can license your music and get a royalty if someone uses it. Much music is licensed for YouTube videos, commercials, etc.

There is a greater demand for music than ever, and people will pay to have it.

It is important to have your music available for people to search. This guide will show you how to license your music.

17. Make an app

You likely have many apps installed on your Smartphone or tablet. Have you ever thought of an app idea? You might consider hiring a programmer for your app. For residual income, you could also sell the app on the App Store.

Affiliate Marketing

Affiliate marketing refers to the practice of becoming an affiliate with a company to earn a commission on products. This method is best for people who have blogs or websites. It takes time to build up the income before it becomes passive.

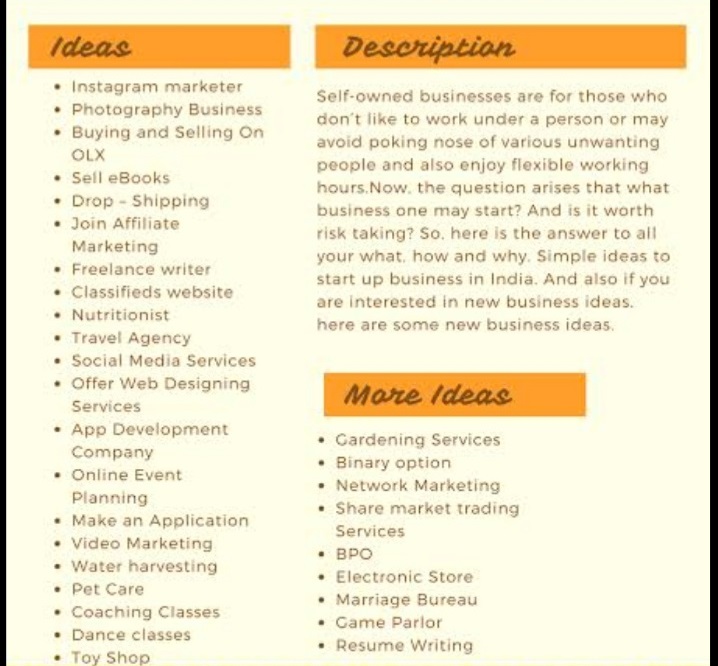

19. Network Marketing

Multi-level marketing or network marketing seems to be in vogue. Multi-level marketing companies include AdvoCare, Young Living Oils, and Pampered Chef. Network marketing can help you earn passive income by building a team under you (often called a downline). You can make commissions on their sales if you have a large group.

20. T-Shirts designed by Design

Cafe Press allows users to create custom T-shirts through their website. You can earn royalties if your design is popular and sells well.

Amazon is also in this industry. Amazon now offers Amazonmerch. This allows you to upload your designs, and Amazon will take care of all the rest (making, packing, and shipping).

21. Sell digital files on Etsy

I have been interested in home decor recently and had to go to Etsy to search for exactly what I was looking for. I ended up buying digital files of the artwork that I wanted to be printed. I was able to download digital files of the wall art that the seller had created. You can also find other digital files on Etsy, such as monthly planners. This could be a great passive income opportunity if you are a graphic designer.

Semi-Passive Ideas for Small Businesses

These are what I refer to as semi-passive income. They work more like a business than the ideas above. All they must be some investment in time and money. You can make more income if you invest and you do it.

These investments must time and effort, so they’re not as passive as savings accounts.

22. Register Your Place on Airbnb

If you own a house or apartment, or if you have a spare room, you should consider listing it on Airbnb to start making money as soon as you book your place. Register your place.

Airbnb is a great way to make money from a space that you already own. Although it does take some work up front to prepare your space, list it, and clean up after guests, it is passive.

23. Car wash

My dream has been to own a carwash. This is a great way for a semi-passive income. A car wash is something that you can hire out, or do once per week.

Side note: I am referring to the basic car wash, which is cinderblocks and a pressure washer. It can also be coin-operated. It’s a business to operate a drive-through car wash.

24. You can rent your car

You can list your car as a rental like you would for your house. You can make passive income by listing your car for rent.

Turo is our favorite partner for renting your car. Turo lets you rent your car and Turo takes care of the rest.

The best thing about Turo? It’s possible to make a decent passive income depending on where you live and what car you drive.

25. Vending Machines

Another low-maintenance small business idea is vending machines. My friend has vending machines in neighboring towns. He refills them and cashes them out every two weeks. He also has a vending machine business as part of his retirement plan.

26. Storage Rentals

My cousin has a storage rental business and gets monthly checks to let customers rent them out. She only seems to work on these when there is an opening in one of the storage units.

You can also rent storage space via a REIT if you aren’t sure how to get into it.

27. Laundromat

This one was not listed because, although it may seem like a semi-passive business, I expect there to be lots of maintenance. This one is up to you.

Simple passive income ideas

Let me mention a few passive income options. These ideas don’t must any upfront investment and do not must money. Even though the earnings are minimal, passive income is still a great option.

28. Cashback Rewards Cards

Cashback rewards are a must if you use a credit card to pay your bills. Your rewards can add over time and you could use the money to start a passive income business. You might lose your rewards if the card you choose has an annual fee. This list contains the top Cashback Rewards Cards.

29. Cashback sites

You should shop online using a cashback website like you would with cashback rewards cards. You’re losing out on free money that doesn’t must much work. We have compared two of the most popular websites – Rakuten and TopCashBack.

30. Apps on Your Phone for Free

Imagine if an app could be installed on your phone and you were paid for it. This app tracks your activities and sells your data, but it’s passive.

Neilson Digital is a great option if you don’t mind doing the standard. The app is easy to download and you can continue doing what you do every day. You are entered for prizes when the app runs in the background. It’s simple and easy to make money without spending anything!